Bank Of Canada Tapering Qe

Food for Thought. Ouvrez un compte bancaire depuis la France.

How The Federal Reserve S Tapering Of Bond Purchases Could Help Bank Stocks The Motley Fool

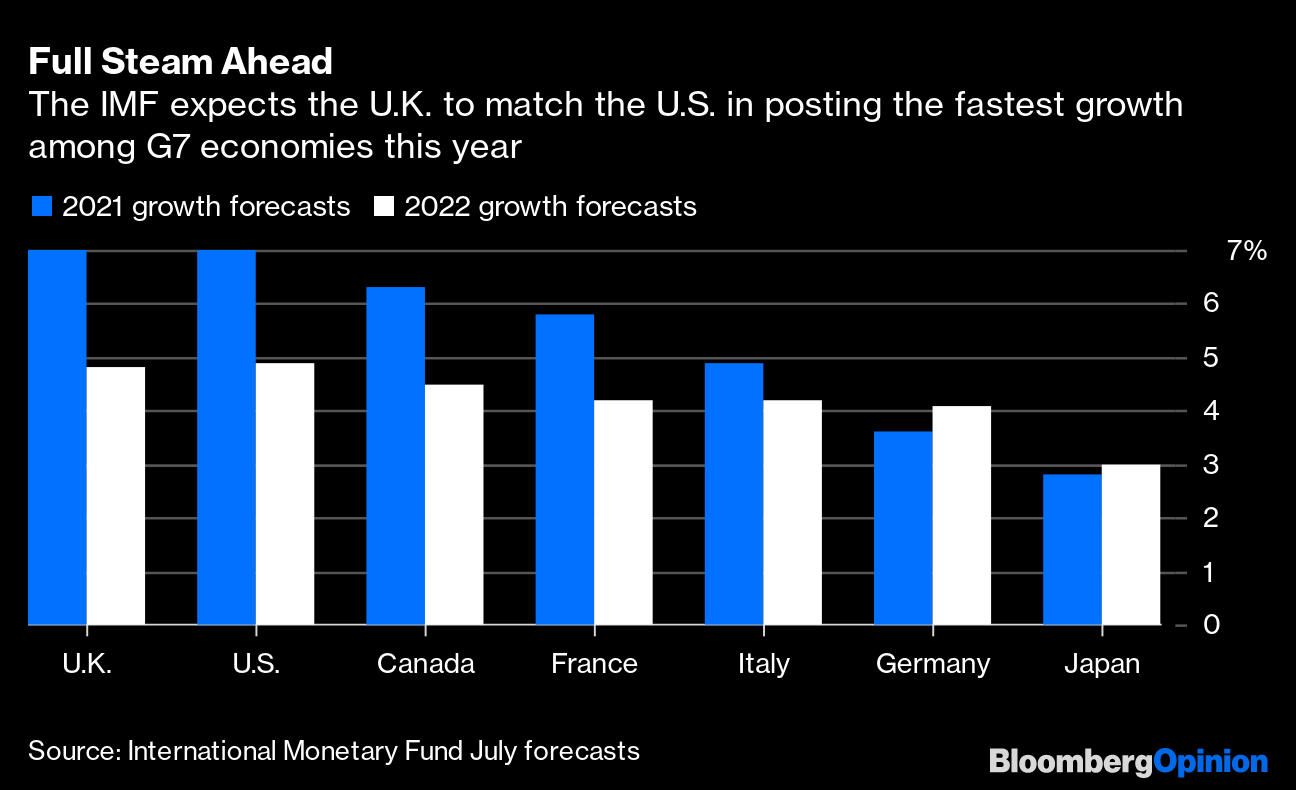

The Bank of Canada BoC is set to taper QE purchases further to C1bn per week with the programme likely concluded in December as the market increasingly prices in 2022 rate hike explained analysts at ING.

Bank of canada tapering qe. Policy makers have been buying a minimum of 4 billion US32 billion in federal government bonds each week to help keep borrowing costs low. Crisis averted until early December October 8 2021. Bank of Canada sees possible positive spending surprise but ongoing need for stimulus.

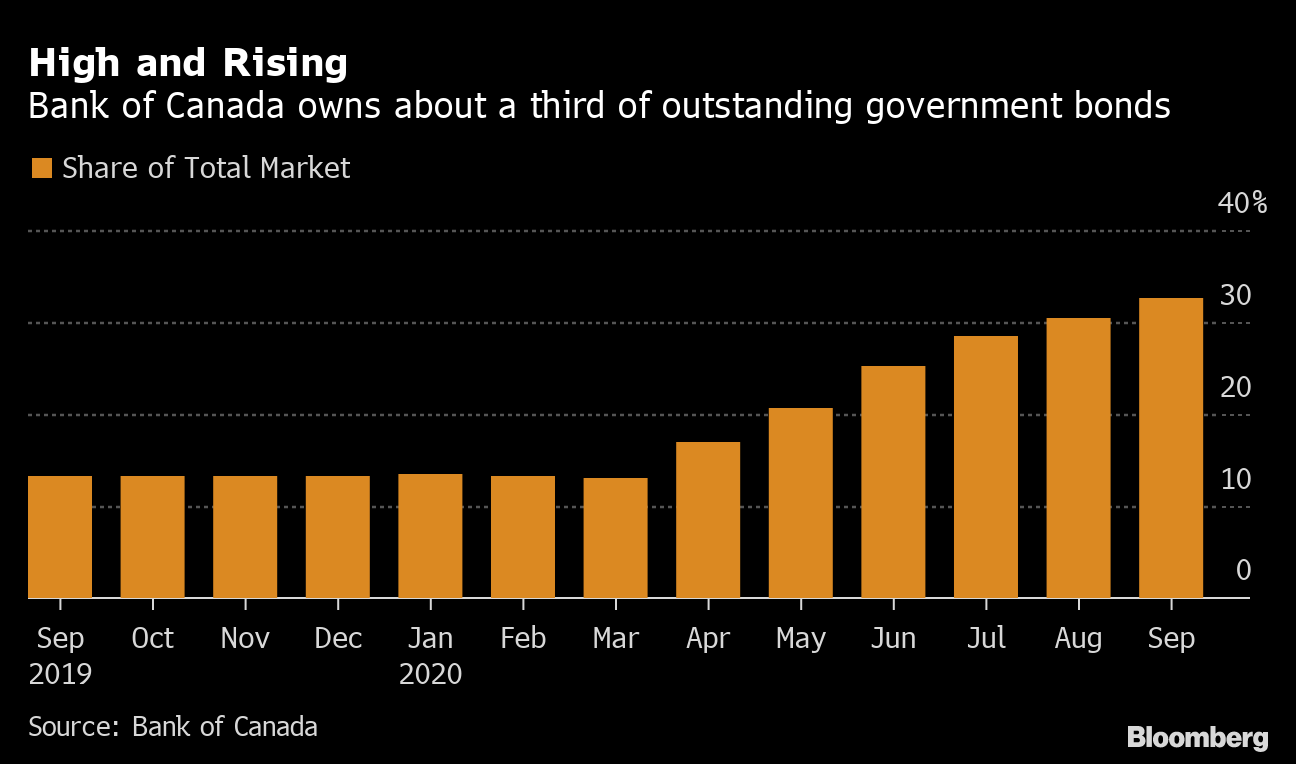

Another round of tapering warranted by a stronger outlook. The Bank broadly endorsed this view as it justified this round of tapering by stating. The Bank of Canada also denied initially it was tapering The Bank of Canada which now has a super-mega housing bubble on its hands blazed the trail last October when it announced that it would taper its purchases of Government of Canada bonds from C5 billion a week to C4 billion a week and that it would stop buying MBS altogether.

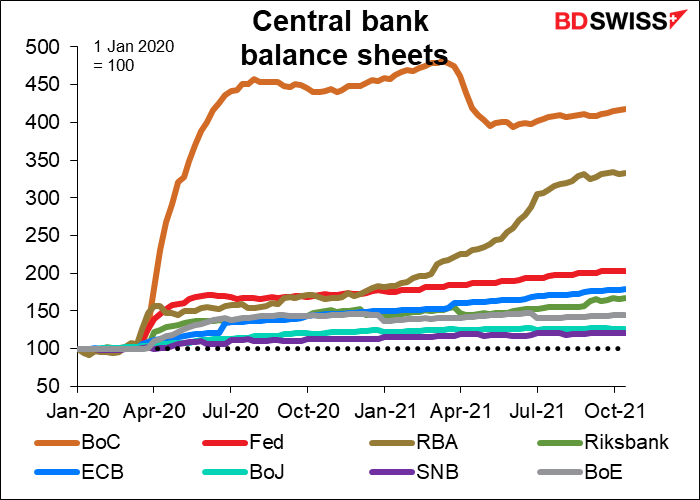

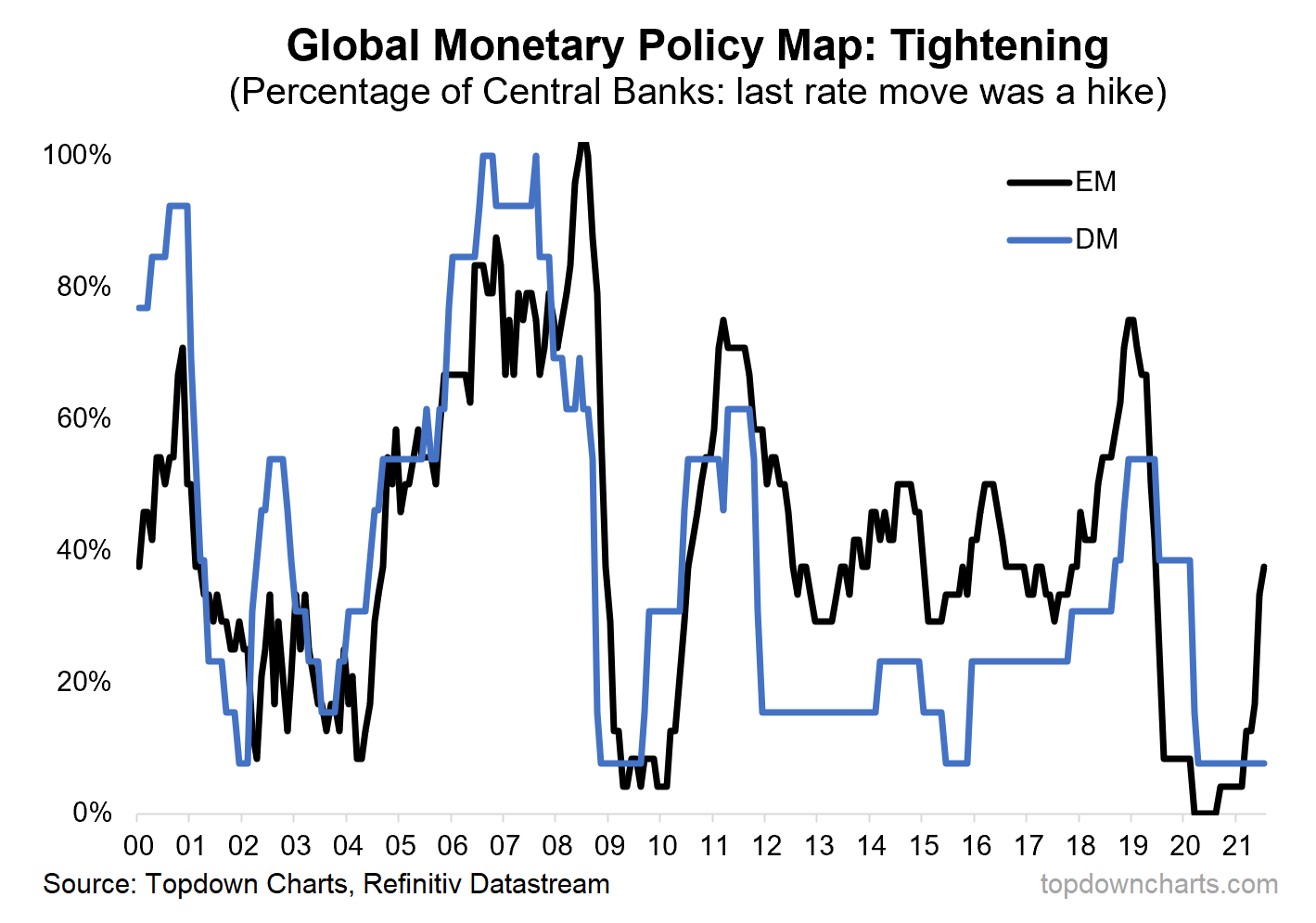

The market has priced in 3 rate hikes in 2022. Bank of Japan Stops QE Reserve Bank of Australia Starts Tapering Bank of Canada Bank of England Already Tapering Amid Shock-and-Awe Rate Hikes in Emerging Markets. This wasnt tapering it said.

Ad Préparez-vous votre immigration au Canada. Buying government bonds raises their price and lowers their returnthe rate of interest they. Economists say that pace may no longer be warranted with an outlook that appears to show the economy growing at a much.

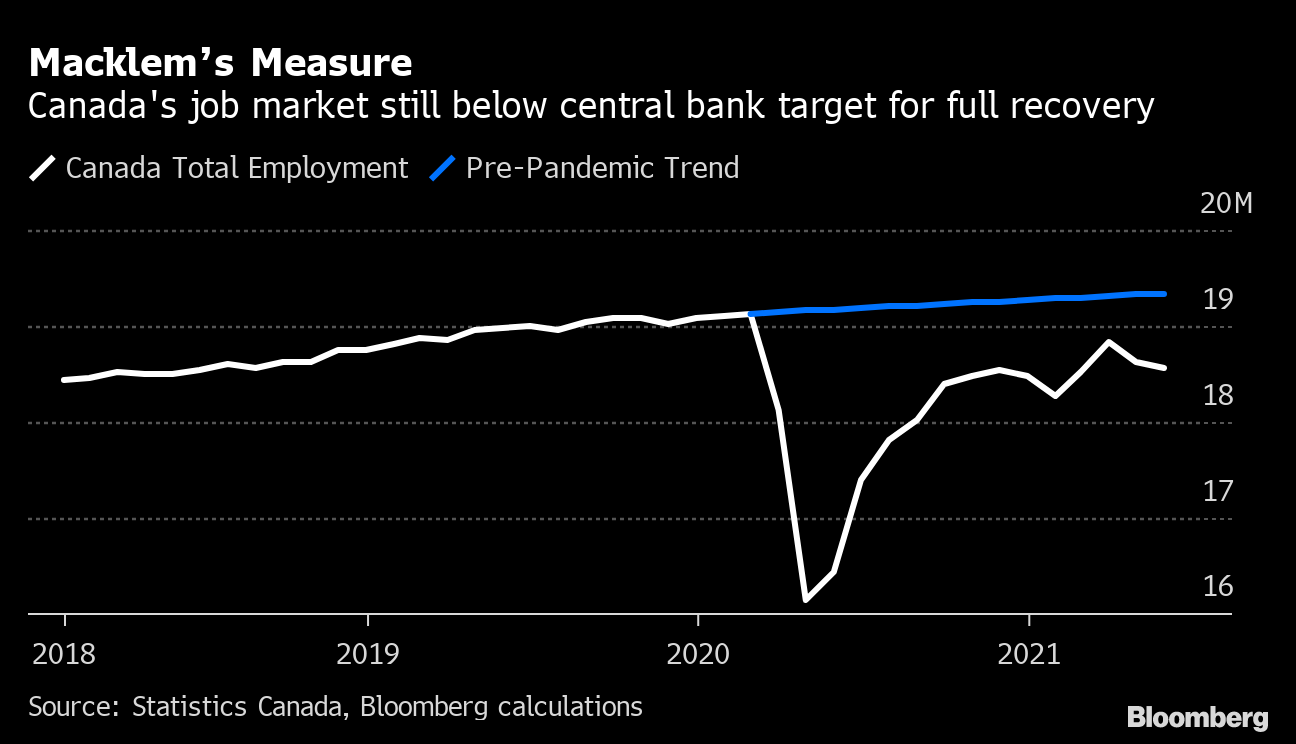

The September jobs report shows tightening labor market and accelerating wage growth October 11 2021. After all the signals coming from the jobs market had been clear. Ouvrez simplement votre compte en ligne.

As further QE tapering to CAD 1Bweek has been fully priced in the focus of this weeks BOC meeting is the forward guidance on rate hike. Canada is on a solid economic recovery path. Risk of The Bank of Canada Not Tapering QE Soon Is Rising.

Tapering is just another tool used by central banks to control interest rates and the perception of future rates. As widely expected the Bank of Canada reduced its weekly bond purchases by another C1bn today from C3bn to C2bn. The Effect of the Federal Reserves Tapering Announcements on Emerging Markets - Bank of Canada.

Canadian GDP down but not out 08312021. When the stimulus stops. New Zealands central bank hiked interest rates on Wednesday for the first time in seven years becoming the second major developed economy to raise.

Under QE a central bank buys government bonds. The Bank of Canada has not changed monetary policy with the overnight rate held at the effective lower bound of ¼ percent and weekly QE asset purchases remaining at 2 billion per week. The Fed is a laggard now discussing when and how to taper QE.

The Federal Reserves quantitative easing QE program has been accompanied by a flow of funds into emerging-market economies EMEs in search of higher returns. It was widely expected to taper to 1Bweek from 2B. Regardless there is little doubt that the Bank of.

Economic danger points to watch for when the punchbowl is pulled away. Bank of Canada lays out QE taper playbook halts other programs. References Arias J Rubio-Ramirez J and Waggoner D 2018 Inference Based on Structural Vector Autoregressions Identified with Sign and Zero Restrictions.

Ouvrez un compte bancaire depuis la France. Bank of Canada decision highlights October 27 2021 The Bank of Canada ends its QE program prematurely tapering its purchases to 0 per month. BoC on hold after Aprils bond tapering Apparently no country is out of the woods yet and the latest setback in economic data could discourage the Bank from extending its tapering.

Tapering is the reduction of the rate at which a central bank buys new assets. The trend might end up delaying the central banks next policy-rate hike By Ephraim Vecina. We continue to see risk that the BoC delays its next QE tapering step to 1B per week from 2B currently beyond October said Nye to clients.

Its most commonly used when talking about the reversal of quantitative easing QE policies and is regarded as the first step in winding down from a period of monetary stimulus. This adjustment reflects continued progress towards recovery and the Banks. Bank of Canada lays out QE taper playbook halts other programs Back to video.

We use QE to counter the risk of deflationa dangerous decline in prices that harms everyone. Job losses and gains at the most productive firms October 8 2021. Ouvrez simplement votre compte en ligne.

In July the BOC tapered its weekly QE pace to 2 billion from 3 billion in a continuation of. US household income growth by quartile October 11 2021. Bank of canada tapering.

Bank of Canada policy meeting. Bank of Canada seen cutting bond purchases in April as peak issuance passes. They expect a neutral impact on the loonie CAD which seems to have most of the positives in the price and may experience corrections in the near term.

Ad Préparez-vous votre immigration au Canada. Profitez de 3 ans sans frais mensuels fixes. A move was hardly likely given the recent shock GDP contraction and the Bank wants to avoid any possibility of being seen taking a view on the Sept.

Bank of canada bond tapering. We expect the central bank to maintain the guidance that a rate hike would come when economic slack is absorbed so that the 2 inflation target is sustainably achieved. The Bank of Canadas Quantitative Easing program appears to be slowing down as the Bank looks to Taper its support for the Canadian Economy.

BoC QE tapering to continue feeding into bond yield increases expert. Experts expect QE to taper soon but RBC sees a risk of delay materializing. QE helps stabilize the economy by making it easier for Canadians to borrow money and for companies to stay in business invest and create jobs.

Profitez de 3 ans sans frais mensuels fixes.

Reserve Bank Of Australia Precautionary Loosening Nasdaq

The Great Exit Central Banks Line Up To Taper Emergency Stimulus Reuters

Qe Party Over Bank Of Japan Stealth Tapers Further Bank Of Japan Japan Bank

Canadian Dollar Cad Spikes As Bank Of Canada Boc Tapers Qe

Bank Of Canada To Reinforce Low For Long Decision Day Guide Bloomberg

Investors Seek Clues On Next Canada Taper Decision Day Guide Bloomberg

How The Federal Reserve S Tapering Of Bond Purchases Could Help Bank Stocks The Motley Fool

Bank Of Canada Cuts Bond Purchases For Third Time Bank Of New Zealand Halts Quantitative Easing

The Bank Of England Is Now The Second Central Bank To Shrink After Canada But Refuses To Allow The Reduction To Shrink After Canada Fr Fr24 News English

A Primer On Quantitative Easing Qe And Its Inherent Limits By Joshua Konstantinos Medium

The Great Exit Central Banks Line Up To Taper Emergency Stimulus Reuters

The Great Exit Central Banks Line Up To Dial Back Emergency Stimulus Reuters

Canada Monetary Policy June 2021

Image Copyright Getty Images Image Caption Mario Draghi Has Mario Draghi Central Bank Europe

Chart Of The Week 1 Em Central Banks By Callum Thomas Topdown Charts

Bank Of Canada Set To Slow Its Bond Buying Ahead Of G 7 Peers Bloomberg